Basics of Accounting for New Business: Start Smart, Grow Confident

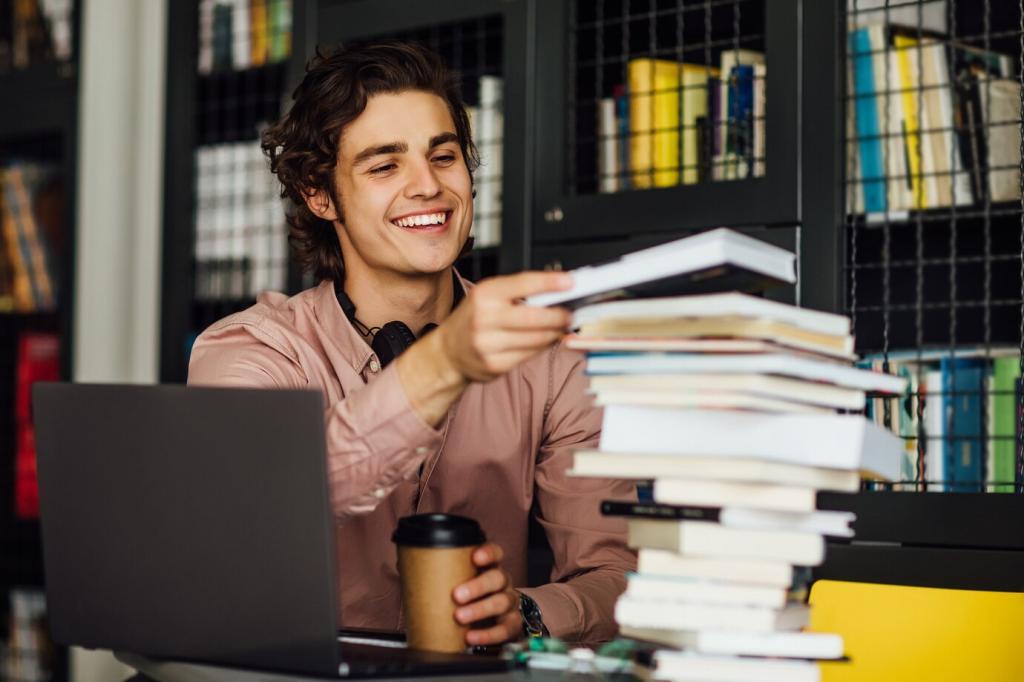

Why Accounting Matters From Day One

A founder once kept receipts in a shoebox, confident the chaos meant momentum. After one missed tax deadline and a panic-fueled night, they switched to simple bookkeeping and never looked back. Organization didn’t slow growth; it multiplied confidence and saved real cash.

Why Accounting Matters From Day One

Paying taxes on time matters, but accounting becomes powerful when it guides pricing, hiring, and inventory. Beyond compliance, good records reveal which products work, where cash leaks, and how to plan calmly. Join the discussion: what insights are you most eager to uncover?

Keep Categories Human-Friendly

Use plain names that match reality: Sales, Cost of Goods Sold, Marketing, Software, Payroll, Taxes. Avoid duplicating categories that confuse. When you review monthly, you should recognize every line instantly. What category names would help your future self the most?

Separate Personal and Business—Always

Open a dedicated business bank account. Mixing personal spending muddies taxes, blurs profitability, and erodes credibility. Clean separation makes reconciliation faster, audits calmer, and decisions clearer. Comment if you need a checklist for opening accounts and setting spending rules.

Make COGS Work For You

Track costs directly tied to sales—materials, packaging, transaction fees—inside Cost of Goods Sold. This reveals gross margin, your most crucial health signal early on. Post your product or service type, and we’ll suggest COGS examples to refine your margins.

Cash vs. Accrual: Choose Your Foundation

Record income when money hits the bank and expenses when money leaves. It’s intuitive, great for very small or early businesses, and helpful for immediate cash visibility. If simplicity keeps you consistent, cash basis might be the best starting point.

Daily and Weekly Habits

Snap receipts immediately, categorize transactions every few days, and invoice the moment work closes. These tiny actions prevent backlog avalanches. When tasks are bite-sized, you’ll never dread bookkeeping again. What daily trigger would remind you to log expenses reliably?

Monthly Reconciliation Ritual

Match your bank statement to your ledger monthly. Reconciliations catch duplicates, missed charges, and fraud early. Pair it with a calm playlist and a 30-minute block. Share your reconciliation playlist or routine to inspire fellow founders to stay consistent.

Tax and Compliance Basics Without the Panic

Identify your business structure, registration requirements, and any sales or value-added tax needs. Calendar due dates and automate reminders. Clarity beats last-minute scrambles. Drop your country or state, and we’ll highlight common obligations to research with a professional.

Tax and Compliance Basics Without the Panic

Hiring? Separate employees from contractors correctly, track forms, and set aside taxes. Misclassification gets expensive quickly. Build a simple onboarding checklist. What role are you hiring first? Comment and we’ll share a basic compliance starter list to consider.

Budgeting and Forecasting for Your First Year

List expected revenue, fixed costs, and variable costs. Anchor assumptions in real data, even if small. Update after each month’s results. This living plan makes decisions calmer and conversations clearer. What single cost would you most like to reduce this quarter?