Building an Emergency Fund for Your Startup: Your Safety Net for Bold Growth

Why Your Startup Needs an Emergency Fund

From Fragile to Resilient

Startups rarely fail from lack of ideas; they fail from running out of cash at the worst moment. A dedicated emergency fund buys time to pivot, renegotiate, or hold pricing power when pressure mounts.

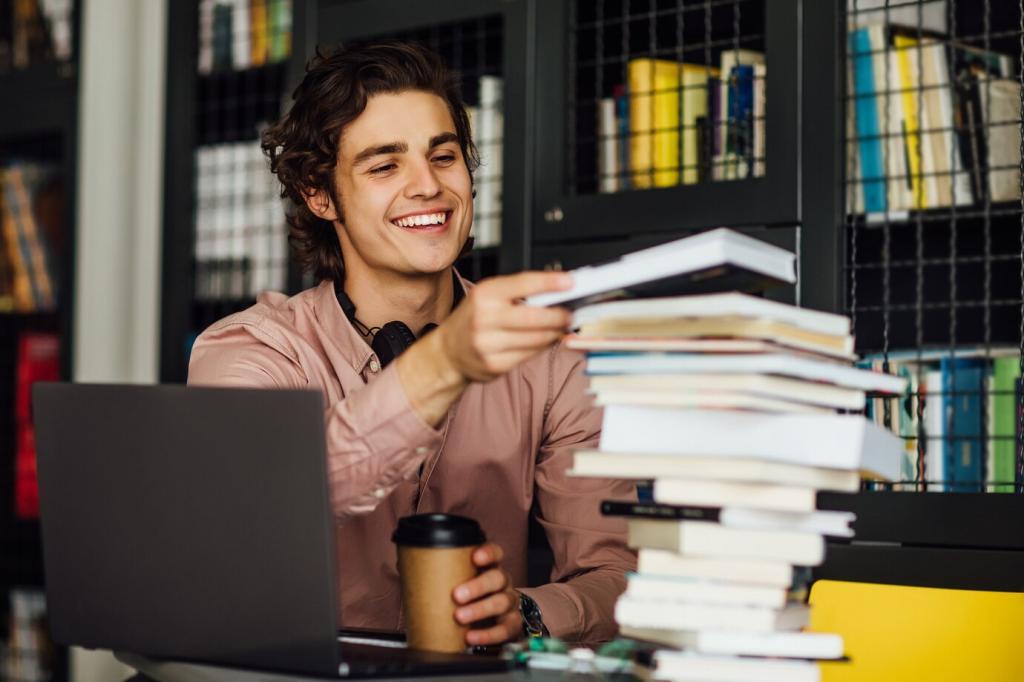

A Founder’s Five-Day Scare

Maya’s coffee-tech startup faced a sudden supplier shutdown. Their emergency fund covered payroll and expedited a new contract, preventing churn. Those five days, funded by foresight, saved three years of reputation.

Investor Confidence, Not Just Survival

Disciplined reserves signal operational maturity. Investors read your cash safety net as stewardship, not timidity, which can unlock better terms and patient support when your experiments need extra runway.

Use actual trailing three-month average burn, including hidden costs like chargebacks, contractor creep, and freight. Hope is not a plan; base your safety net on cash that actually leaves your bank.

How Much Should You Save?

Where to Park Your Emergency Cash

Use FDIC-insured, multi-bank sweep accounts or reputable high-yield savings with clear access rules. Prioritize daily liquidity and strong banking partners, not teaser rates that complicate transfers when timing matters most.

Where to Park Your Emergency Cash

Short-duration T-bills and institutional money market funds can add safe yield with quick settlement. Ladder maturities so part of the fund is always near-cash, reducing timing risk during unexpected withdrawals.

Where to Park Your Emergency Cash

Keep the emergency fund in a separate account with clear labeling and restricted permissions. Out of sight reduces casual raids. Subscribe for a simple account structure template to share with your finance lead.

Funding the Fund Without Starving Growth

Divert a fixed percentage of every receivable into the emergency account. Small, consistent transfers compound credibility and reduce the temptation to postpone savings during exciting growth spikes.

Funding the Fund Without Starving Growth

Audit unused SaaS seats, idle cloud resources, and vanity experiments. Redirect those savings to the fund. Founders often uncover one to two months of runway by simply tightening operational hygiene.

Rules, Governance, and Access

Require two approvals—CEO plus finance lead or a designated board member—for any withdrawal. Maintain written justification, amount, and repayment plan to keep discipline strong under emotional pressure.

Stress-Test Your Cash and Update the Fund

Build a simple weekly model with inflows, outflows, and expected balances. Update every Friday. This cadence reveals patterns early, letting you adjust spending before the emergency fund becomes a crutch.

Stress-Test Your Cash and Update the Fund

Model three cases: base, downside, and severe downside. Include delayed receivables and lost top customer. Align your fund target with the severe case so nasty surprises feel like manageable detours, not derailments.

Stress-Test Your Cash and Update the Fund

Set automated alerts when balances fall below two, three, or four months of runway. Predefine actions for each threshold to remove hesitation and keep decisions calm, fast, and consistent.

When the Storm Hits: How to Use the Fund

Tell your team what happened, what you’re funding, and how long the buffer lasts. Clarity preserves morale. Customers respect timely updates and realistic timelines more than perfect promises.

When the Storm Hits: How to Use the Fund

Allocate in phases: immediate containment, stabilization, then recovery. Track outcomes weekly and cap disbursements unless milestones are met. This rhythm turns panic into purposeful progress and protects the remaining cushion.